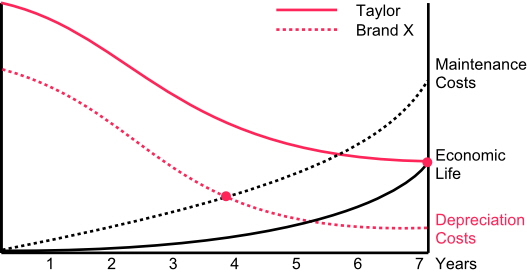

There seems to be a misconception about leasing. In reality, there are many reasons leasing is an attractive option for heavy equipment. In business today, it's important to understand these options. Heavy equipment, like all vehicle, will eventually break down. This is the first truth you need to know. At sometime in the life cycle of your equipment, the maintance cost will out weigh the depreciation cost. In other words, it will cost more to maintain than the equipment is actually worth.

Taylor Leasing would like to address some of these misconception. Below are questions that our customers have asked. Under each question you will find helpful graphs that will help dispell some of these myths. At Taylor Leasing, we strive to provide our customers with the best possible service. Taylor Leasing is backed by forklift manufacturer, Taylor Machine Works, Inc. A name that has become synonymous for quality.

Frequently Asked Questions

Why Lease?

Answer:

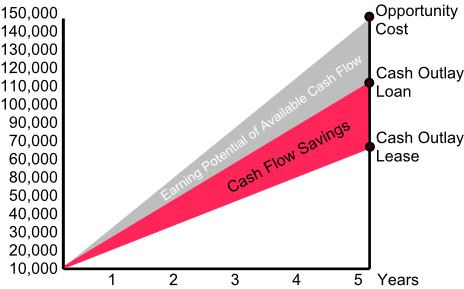

The main goal of leasing is the lowest cost use (not the owner-ship) of an asset to make money, while freeing cash flow, and maintaining existing credit lines.

• Convenience

What is your time worth? To lease you can arrange your financing with a simple application, at comparable rates to your bank, without the lengthy paperwork and approval process.

• Free Budget Restraints

A lease payment is the lowest cost use of a generating asset, which frees money for working capital.

• Rising Rates

In a rising rate economy, it's smart to lock in rates on long-term capital.

• Alternate Source of Capital

With leasing, you don’t have to find new funding sources, and you can use your existing credit lines for emergency needs.

• Good Financial Management

A true lease makes sense when external cost of capital is less than your internal rate of return on working capital.

• Pay For What You Use

You can't pay payroll by building equity in a capital investment, and a true lease does not accumulate equity in a depreciating asset.

Why Choose Taylor Leasing?

Answer:

Taylor Leasing and Rental® can provide incentives and opportunities beyond the reach of third party finance companies.

Taylor Leasing can structure factory-backed future guarantee values that your third-party lender can't. It's that simple. We believe Taylor products are the best of their kind and we back that belief when we structure financial products for you.

We offer over a hundred products that can fit the specific needs or your business and improve your profit with reduced operating cost, and increased up-time.

Lease Factor

We don't focus on rates, we have you pay for what you use. The most important element in the lease is the residual value. How much you use your equipment, its condition and its maintenance are key in determining the best lease for you.

Economic Life of an Asset

See why financing Taylor machines over its competitors makes great financial sense.

Isn't leasing just for companies with poor credit?

Answer: No

Leasing requires better credit than borrowing.

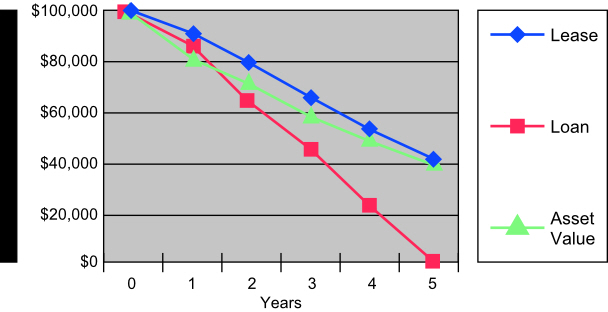

No equity build-up with leasing equipment

Declining Value of an Asset

Common Leasing Myths

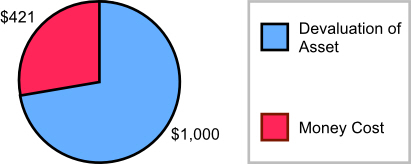

The lease payment is primarily determined by the interest rate.

Answer: False

The residual value has 1.3 times the impact on the payment as the interest rate.

Lets take a look. Example: $100,000 equipment cost at a 5 year term with a 40% residual, and at 7% interest rate.

Payment = $1,421.00 thats a lease factor of only .01421

Breakdown of $1421 Payment @ 7%

Customers prefer owning to leasing, so the only customers that lease are the ones that can't buy.

Answer: False

It's true that there are some advantages to owning like the pride of ownership and the build up of equity, but leasing pays for the functionality. The economic life of a piece of equipment is based on the annual running hours, maintenance, and the application. The economic useful life is the same whether the equipment is leased or owned.

Below we show that at sometime in the life of a piece of equipment the maintenance cost will outweigh the equipment's value. That is why many companies prefer to lease rather than purchase. The company pays for the use of the machine enabling the company to manage its assets more effectively.

Leasing is more expensive than owning.

Answer: False

- Leasing is the lowest possible cost for use of the equipment.

- Leasing is good financial management.

- Leasing provides matched term financing.